A version of this article was previously published in the December 2018 issue of California CPA Magazine.

The 2019 tax busy season is quickly approaching. For most taxpayers, this will be the first season that impacts of the new tax reform will take place.

This means now is the time to familiarize yourself with recent California-specific tax updates that may affect 2018 tax-year filings as well as items that may have been missed in 2017 filings.

California and Federal Tax Reform

Tax reform—commonly known as the Tax Cuts and Jobs Act (TCJA)—affects individuals, businesses, tax-exempt entities, and government entities. Many of these changes will affect individuals and organizations in California in various capacities, but it’s worth noting California doesn’t conform to most of the federal tax-law changes. Below are changes to tax laws that California taxpayers should watch for.

Qualified Business Income Deduction

The IRS issued proposed regulations for the newly created Internal Revenue Code (IRC) Section 199A, which allows certain owners of sole proprietorships, partnerships, trusts, and S corporations to deduct 20% of qualified business income. The deduction is subject to certain limitations and is effective for tax years beginning after December 31, 2017, through December 31, 2025.

California doesn’t conform to IRC Section 199A, and there is no existing proposal to change for the 2018 tax year.

1031 Exchanges

The new federal law retains IRC Section 1031, Exchange of Real Property Held for Productive Use or Investment, for real-estate exchanges. However, it may no longer be used to defer taxes for transactions involving personal property and is limited to like-kind exchanges of real property that isn’t held primarily for sale.

California conforms to IRC Section 1031, as of the specified date of January 1, 2015, with modifications, but it doesn’t conform to the new federal change enacted by tax reform. Because of this, taxpayers may run into a situation where a like-kind exchange may qualify for deferred tax gain under California law and not federal law.

Full-Expensing Deduction

The cost of certain tangible business-use personal-property assets can be written off using the full-expensing deduction—which allows for 100% depreciation—in the year they’re placed in service to offset any capital gain or depreciation recapture recognized in the same or future years. California doesn’t conform to these provisions.

State and Local Tax Deduction

Under federal tax reform, an individual’s deduction for the aggregate amount of state and local taxes (SALT) paid during a calendar year is limited to $10,000—or $5,000 in the case of a married individual filing separately. SALT payments exceeding those amounts are not deductible for federal personal income tax purposes.

California conforms to the deductibility of taxes as of the specified date of January 1, 2015, with modifications—for example, California doesn’t allow a deduction for SALT paid in the calculation of income. California doesn’t conform to the new federal SALT deduction limitation enacted by tax reform.

Tax Form Changes

Tax reform changed federal itemized deductions as well as the federal standard-deduction amounts beginning with the 2018 taxable year. These changes significantly impact California Schedule CA (Forms 540 and 540NR) and California adjustments—requiring the Franchise Tax Board (FTB) to make major changes to the forms.

Once made, these changes will put the entire form into a consistent format while allowing a taxpayer to see California adjustments made to each federal line item.

Untaxed Foreign Earnings

Under IRC section 965, Treatment of Deferred Foreign Income, US shareholders are now required to pay a one-time federal transition tax on untaxed foreign earnings of certain foreign corporations, as if those earnings had been repatriated—or deemed dividend—to the United States. This means certain taxpayers may have had to pay additional federal tax under IRC Section 965 when their 2017 federal tax returns were filed.

2017 Adjustments

California doesn’t conform to IRC Section 965, which means taxpayers that reported IRC Section 965 amounts on their 2017 federal tax return should have made an adjustment on their 2017 California tax return.

Adjustments After 2017

When a foreign corporation makes an actual dividend distribution of the previously tax foreign earnings, those earnings aren’t taxed again for federal purposes. For California income tax purposes, the actual dividend distribution hasn’t been taxed and may be includible in taxable income for California.

California Tax Credits

Earned Income Tax Credit

The California Earned Income Tax Credit has been extended by Senate Bill (SB) 855 to help put money in the pockets of low-income taxpayers. The bill revised the age limit for an eligible individual without a qualifying child to 18 years or older and increased the income thresholds.

The FTB web page (ftb.ca.gov) details credit amounts, income limits, qualifications, and additional information.

California Competes Tax Credit Extension

SB 855 also extends the California Competes Tax Credit (CCTC) program for an additional five years. CCTC is an economic-development incentive to attract or retain businesses considering a significant new investment in California by reducing taxpayers’ personal income tax or corporation tax.

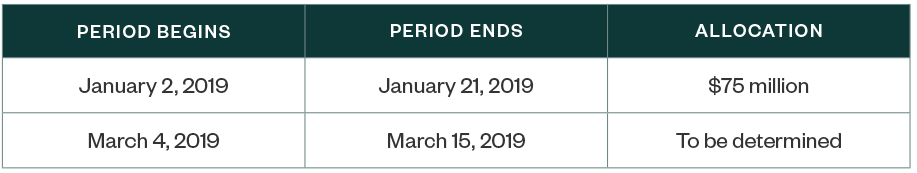

In the CCTC program’s 2018–2019 fiscal year, the California Governor’s Office of Business and Economic Development is authorized to negotiate up to $180 million in tax credits over three application periods. However, the application process is very competitive.

The first application period ended on August 20, 2018. The next two CCTC application periods for the program’s 2018–2019 fiscal year are as follows:

New Employment Credit Extension

SB 855 extends the New Employment Credit program for an additional five years. For further details on how to qualify for the credit, visit the FTB web page.

California Legislative Update

The California legislature proposed more than 900 bills in 2018. Here are selected highlights that may be useful to know for 2018 tax-year filings.

Corporate and LLC Dissolution, Cancellation, and Tax Abatement

Signed by Governor Jerry Brown on September 22, 2018, and effective as of January 1, 2019, Assembly Bill (AB) 2503 subjects domestic corporations and LLCs to administrative dissolution or administrative cancellation if their corporate powers were suspended by the FTB for 60 continuous months. As part of the law, the FTB must provide notice to the company of any pending action.

Once dissolution or cancellation has occurred, the bill authorizes the FTB to abate—upon written request by a qualified entity—the unpaid qualified taxes, interest, and penalties for the taxable periods in which an entity certifies it wasn’t doing business in California.

The bill also requires the FTB to prescribe rules and regulations to carry out these abatement provisions, which the agency is currently in the process of producing.

Partnership Audit Rules

On September 23, 2018, Governor Brown signed SB 274, incorporating into California law certain federal provisions related to the audit of partnerships. The bill requires a partnership to report each change or correction to the FTB for a reviewed period within six months after the date of each final federal determination if the following are true:

- Any item required to be shown on a federal partnership return is changed or corrected.

- The partnership is issued an adjustment or makes a federal election for an alternative to payment.

SB 274 closely aligns with federal rules, but there are some differences where a partnership is unitary with another entity or where a partnership elects to push out federal audit adjustments to its partners.

While the federal partnership representative is the default representative in California, SB 274 does allow partnerships to designate a separate partnership representative for California tax purposes. It also includes provisions addressing tiered partnership structures that allow an additional 90 days from the federal deadline to comply with all necessary filing and payment requirements.

This bill took immediate effect upon signing.

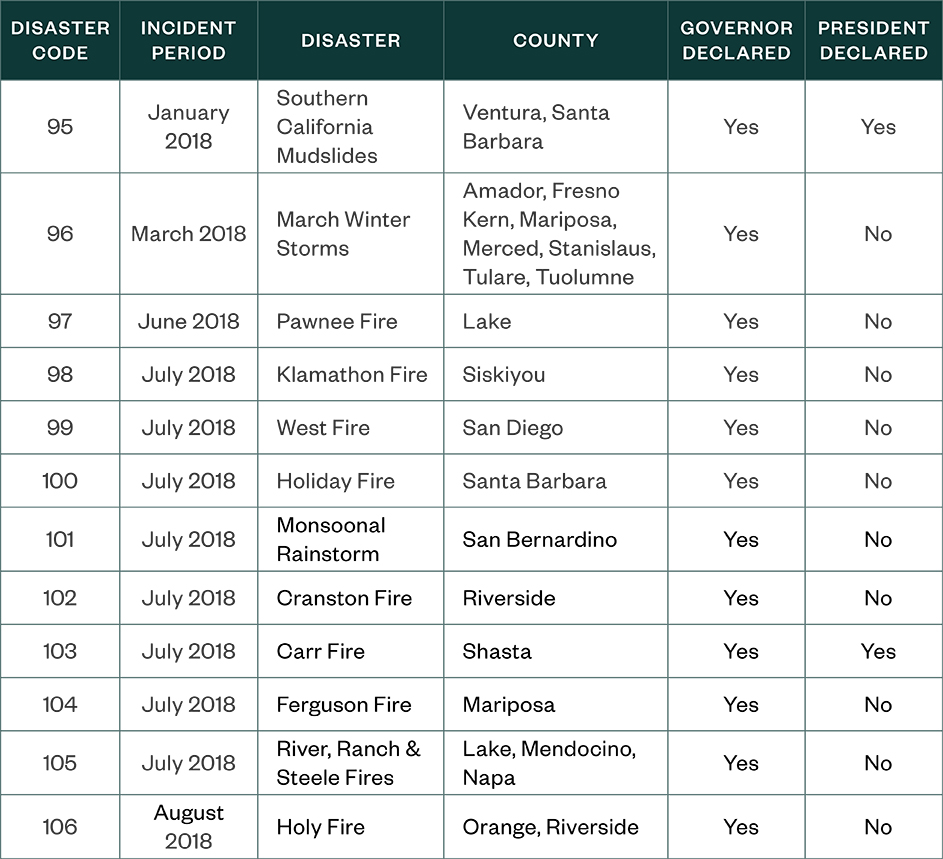

2018 Disaster Losses

Taxpayers may deduct a disaster loss for any loss sustained in California during an event proclaimed by the governor to be a state of emergency. California hasn’t conformed to the new federal tax law in this regard and instead generally follows the former federal law regarding the treatment of losses incurred because of a casualty or a disaster.

Hurricanes Florence and Michael

The FTB follows the announced federal postponement periods for hurricanes Florence and Michael. Affected taxpayers were granted an extension to file tax returns and make payments until January 31, 2019, and February 28, 2019, respectively. This means, for example, if Hurricane Florence impacted a taxpayer who earns income in California, that taxpayer has extra time to file a California tax return.

The IRS disaster relief web page (irs.gov) lists additional designated areas eligible for a postponement period, which the FTB will also follow, cancelling any interest and late-filing or late-payment penalties that would otherwise apply.

Other 2018 Disasters

Taxpayers may deduct a disaster loss for any loss sustained in a California city or county proclaimed by the governor to be in a state of emergency. For more information regarding California disaster losses, see the FTB website and Publication 1034, Disaster Loss How to Claim a State Deduction.

The following includes California Qualified Disasters published on the FTB website as of October 31, 2018.

How to Claim a State Tax Deduction for Disaster Loss

Taxpayers can claim a disaster loss in the taxable year the disaster occurred or in the taxable year immediately before the disaster occurred. Use the disaster code from the chart shown above if e-filing. If filing a paper return, print the following information in red ink across the top of the document:

- Disaster

- Name of disaster in the governor’s

- The year the loss occurred as shown in the governor’s state-of-emergency proclamation

Miscellaneous

Independent Contractors—Dynamex Operations West, Inc. v. Superior Court

On April 30, 2018, the California Supreme Court issued a unanimous 82-page opinion in Dynamex Operations West, Inc. v. Superior Court. The ruling creates a new standard for California that presumes certain workers are employees instead of independent contractors. Companies that use independent contractors may be impacted.

As part of the decision, the court adopted a new ABC test to determine—for wage-order purposes—whether a hiring entity has engaged an employee or a contractor. This creates a challenging new standard for employers to consider when hiring a professional to provide services.

ABC Test

Under the new ABC test, a hiring business must demonstrate a worker meets all three of the following requirements to qualify as an independent contractor:

- Not controlled or directed by the hirer in connection with performing the work—both as defined in the contract as well as in reality

- Performs work outside the usual course of the hiring entity's business

- Customarily engaged in an independently established trade, occupation, or business of the same nature as that which the hiring entity performs

There’s ongoing work being done to provide more clarity around the application of these rules by California’s Employment Development Department as well as additional court cases. For now, they signal a significant shift in how independent contractor relationships are reviewed by authorities when there’s an unemployment claim against a prior employer or an employment audit.

Corporate-Refund and Personal-Income-Tax Interest Rates

The FTB will pay 1% interest on corporate refunds during 2018 and will begin paying 2% interest on corporate refunds beginning January 1, 2019. The corporation overpayment rate will stay at 2% through June 30, 2019.

The interest rate for personal income tax underpayments and overpayments, corporation underpayments, and estimate penalties will stay at 4% through December 31, 2018. This rate will increase to 5% for the period between January 1, 2019, through June 30, 2019.

For interest rates after June 30, 2019, the FTB will provide more information on their website once available.

Doing Business in California and Economic-Nexus Thresholds

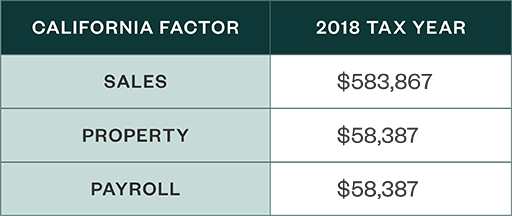

Doing business is defined as actively engaging in any transaction for the purpose of financial or pecuniary gain or profit. For taxable years beginning on or after January 1, 2011, a taxpayer is seen as doing business in California for a taxable year if any of the following conditions are satisfied:

- The taxpayer is organized or commercially domiciled in California.

- California sales exceed the lesser of $500,000 or 25% of total sales.

- The real property and tangible personal property in California exceed the lesser of $50,000 or 25% of total real property and tangible personal property.

- The amount paid in California for compensation exceeds the lesser of $50,000 or 25% of total compensation paid.

To determine the amount of a taxpayer’s sales, property, and payroll for doing-business purposes, the FTB includes the taxpayer’s pro-rata share of these items from partnerships, LLCs treated as partnerships, and S corporations.

The doing-business thresholds for taxpayers are indexed for inflation and revised annually. For taxable years beginning on or after January 1, 2012, these thresholds also have been indexed by California’s Consumer’s Price Index.

2018 Doing-Business Thresholds

Additional Clarification on “Doing Business” in California

Relating to the 2017 case of Swart Enterprises, Inc. v. FTB, the FTB issued a new legal ruling to modify Legal Ruling 2014-01. The modification provides additional distinction between “manager-member” LLCs and “member-managed” LLCs.

If an LLC classified as a partnership for tax purposes is “doing business” in California under Revenue & Tax Code Section 23101, the members of the LLC are themselves generally considered to be “doing business” in California. Legal Ruling 2018-01 states that “a narrow exception may apply in limited circumstances.”

We’re Here to Help

To learn more about how tax changes could affect you or your business, contact your Moss Adams professional.